Paid Time Off

Thanks to the SEIU 503 bargaining unit, care providers may receive a wage increase starting January 2026! If you want your PTO paid out at the new higher rate, you need to request PTO on or after March 1, 2026. This is because PTO and pay rate adjustments earned in one month are not reflected in your PTO earnings until the end of the following month.

When you receive a pay increase, please account for this processing time for all PTO benefit requests.

Helping you take time off from work when you need to.

Benefit Summary

The Carewell SEIU 503 Paid Time Off (PTO) benefit helps you take time off from work when you need to.

Taking time off work is crucial to your physical, mental, and emotional health! That’s why Carewell SEIU 503 offers eligible care providers up to 60 hours of PTO benefits every year. You can earn 1 hour of PTO for every 20 hours worked, up to a maximum of 5 hours of PTO benefits every month.

In 2026, you can earn 60 hours of PTO every year!

Thanks to the SEIU 503 bargaining unit, in 2026, you can earn up to 5 hours of PTO every month and 60 hours every year through Carewell SEIU 503. Previously, care providers could earn a maximum of 48 hours of PTO every year.

Important things to know

Fill out the Form W-9

- You must fill out a Form W-9 to be eligible for your PTO benefit. If Carewell SEIU 503 doesn’t have your Form W-9 on file, you won’t receive the PTO benefit.

- Any PTO benefit hours older than 12 months will expire and you will lose those benefit hours if a Form W-9 is not filled out and sent to Carewell SEIU 503.

- If you have a Form W-9 on file with us, you can save up to 24 months’ worth of your PTO benefits before a payment is automatically sent to you. Or you can request to use some of your PTO benefits before you reach 24 months and save the rest to use later.

You do not need to find a replacement

- It isn’t your responsibility to find your replacement when you take paid leave from your consumer-employer.

Form 1099

- The paid time off (PTO) benefit is taxable income. If you receive $600 or more of your PTO benefit during the year, you will be sent a Form 1099 in the mail. This form is sent when taxable income does not have taxes deducted but is still considered taxable by the IRS.

- Make sure to keep the Form 1099 safe so you have it for when you file your taxes.

- The benefit is still taxable income even if you do not receive a Form 1099. Keep track of all PTO benefits you request during the year.

How to access your 1099

- Mail

- You receive the Form 1099 by mail to the address we have on file generally around January-February.

- Download it online on MyCarewell503

- You can download the Form 1099 on MyCarewell503 (currently available in English). You receive an email from our partner Zenwork with steps on how to access and print the Form 1099 online. If you want to go online to get your 1099 or if you lost it in the mail, please follow these steps: CarewellSEIU503.org/access1099.

Check your PTO balance Updating or checking your preferred payment method

How It Works

Eligible care providers can earn 1 hour of PTO benefits for every 20 hours worked, up to a maximum of 5 hours of PTO benefits every month.

Once you have at least 8 hours of PTO benefit in your balance, you can request hours, or you can save hours to take a well-earned vacation!

Eligibility for PTO Benefits

Read the requirements below to learn more about eligibility for Carewell SEIU 503 Paid Time Off benefits.

Eligibility Requirements

To be eligible for Carewell SEIU 503 paid time off benefits you must:

Have a Form W-9 on file with Carewell SEIU 503 Benefits. The PTO benefit is taxable income. You will not receive your PTO benefit if we do not have your Form W-9 on file with us.

Work at least 20 hours a month to be eligible for 1 hour of PTO benefits. If you work less than 20 hours in a month, you will not earn PTO benefit hours that month. You need 8 or more PTO benefit hours to be able to request this benefit.

Eligible hours

“Work hours” means the hours paid by Acumen, DHS, and/or PPL on behalf of your consumer.

Earning PTO Benefits

You can earn up to 5 PTO benefit hours every month.

Example: if you worked 110 hours in 1 month, you have earned 5 hours of PTO benefits. This is because 20 hours of work is equal to 1 hour of PTO benefits and you cannot earn more than 5 PTO benefit hours every month.

Hours worked in 1 month cannot be combined with hours worked in another month to earn PTO benefit hours.

Example: If you worked 10 hours in May, and you worked 10 hours in June, you cannot combine those work hours to earn the 1 hour of PTO benefits.

PTO benefit hours earned for the month are added to the PTO benefit balance at the end of the next calendar month.

Example: You work 100 hours in May, earning 5 hours of PTO. The 5 hours of PTO you earned are added to your balance when hours are received and processed at the end of June.

If you work as both a homecare worker and a personal support worker, all hours worked in a month will be combined to calculate PTO benefit hours for that month.

How to Request PTO

If you have worked the required number of hours to earn at least 8 hours of PTO benefits, you will receive a notice from Carewell SEIU 503. It will include instructions on how you can request your PTO benefits. Please make sure to view your PTO benefits balance first before requesting your PTO benefits.

Check your PTO balance using MyCarewell503 (currently available in English). Or call us at 1-844-503-7348.

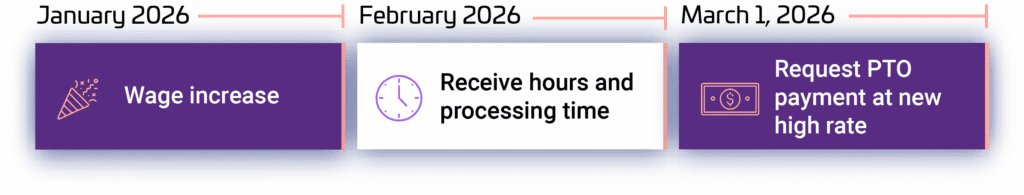

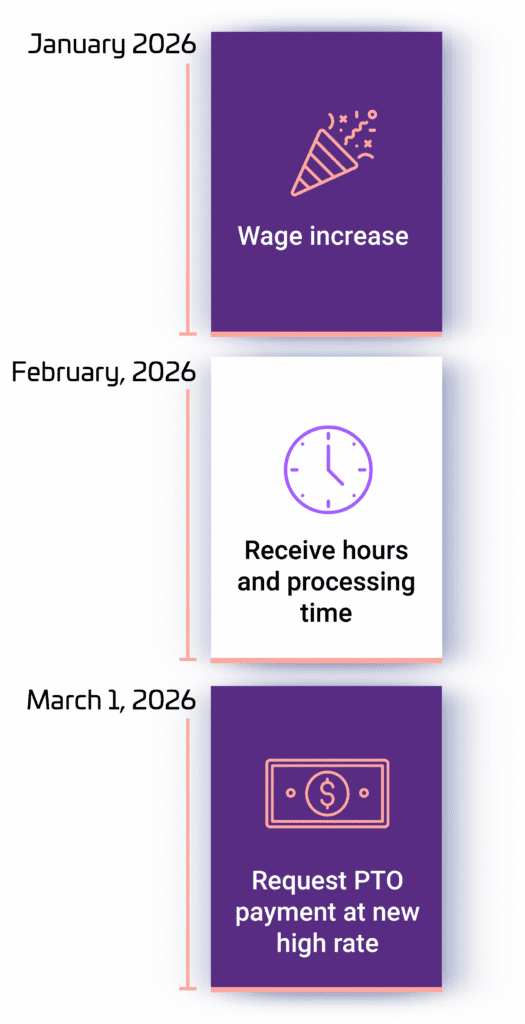

Processing timeline of Paid Time Off (PTO) payments and wage increase

Thanks to the SEIU 503 bargaining unit, care providers may receive a wage increase starting January 2026! If you want your PTO paid out at the new higher rate, you need to request PTO on or after March 1, 2026. This is because PTO and pay rate adjustments earned in one month are not reflected in your PTO earnings until the end of the following month.

When you receive a pay increase, please account for this processing time for all PTO benefit requests.

Use MyCarewell503 to request your PTO.Request your PTO Benefits

Benefit Details

Receive your PTO Benefits

To receive your PTO benefits, you need to fill out the Form W-9 if you haven’t already done so. If you do not, you will not be paid, as this benefit is taxable income. You will receive your payment by check in the mail unless you choose to receive it by direct deposit into your bank account.

Receive your PTO Benefits by Direct Deposit

Direct deposit is the fastest and safest way to collect your PTO benefit! Fill out the Direct Deposit form and include a copy of a voided check or your bank account information.

You only need to complete the Direct Deposit form once; we will note your preference for future payments. You can’t use direct deposit if you don’t have a bank account.

Updating or checking your preferred payment method

Fill out the PTO Designation of Beneficiary Form

With the PTO benefit, we urge you to complete the Designation of Beneficiary Form so that the person you choose receives your unclaimed PTO payment in the event of your death.

Contact Information

Carewell SEIU 503 Benefits

1-844-503-7348, Monday–Friday, from 8 am–6 pm PST.

Reasons to contact Carewell SEIU 503 Benefits :

- Request your PTO balance (how many hours you have left)

- You believe the PTO check you received is for the wrong amount

- Any question you have around PTO benefits

Frequently Asked Questions

Read common questions about the Carewell PTO benefit. See the FAQs page for more information.